HOW-it-WORKS

A detailed explanation of how Passivbot engine works and the different settings parameters are available here. In order to initiate your personalized Passivbot there are a set of minimum parameters that you need to define. Below is an interactive tool to help define these parameters in 4 simple steps.

1. Select crypto exchange.

Each crypto exchange has minimum order size/cost which will dictate the minimum amount of wallet funding required for Passivbot to operate optimally. The minimum wallet funding is calculated using the exchange’s minimum cost/order size, along with the number of coins you chose to trade, wallet exposure limit, and bots initial entry position (typically 0.5-2.0% range). For example, if the exchange minimum order size is $5 and bots initial entry position is 2.0% and 4 coins are traded and total wallet exposure is 2.0, then the minimum wallet funding is ($5 * 4) / (2.0% * 2.0) = $500.

2. Select wallet exposure limit for long and/or short trades.

Wallet exposure limit is the highest ratio of position size to account balance the bot is allowed. Wallet exposure limit may be greater than 1.0 (i.e., 100%) by using leverage. For example, a total wallet exposure limit of 2.0 with 4 coins being traded will assign a wallet exposure limit of (2.0 / 4) = 0.5 or 50% per coin. If DOGEUSDT @ $0.08 is traded with a wallet balance of $1,000, then the maximum possible position is (0.5 * $1,000) / $0.08 = 6,250 DOGEUSDT.

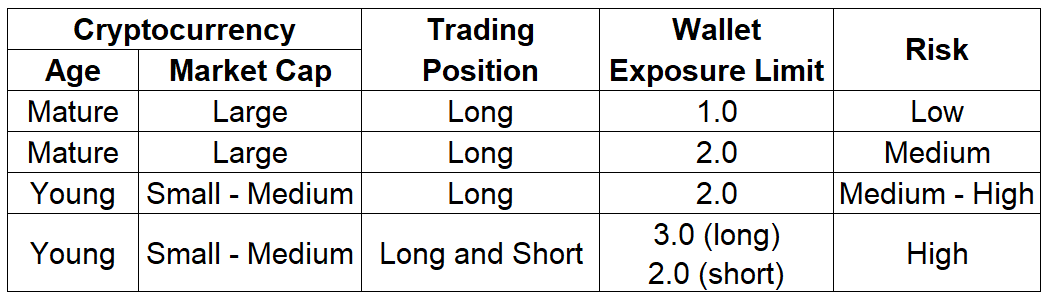

Note, higher wallet exposure limit means higher risk. Long wallet exposure limits greater than 1.0 introduces risk of liquidation. Shorts have liquidation risk for any exposure limit.

The trading strategy may be long-mode only, or short-mode only, or both long and short contracts. Passivbot may hold both long and short position in the same coin at the same time. For example: A long position of 0.002 BTCUSDT @ 41,000 is equivalent to buying 0.002 BTC at price $41,000 per bitcoin. A long position is equivalent to using USDT to buy and hold a coin. The long position profits when price goes up, and loses when price goes down. A short position is equivalent to borrowing the coin, with USDT as collateral, and selling the coin. The short position profits when price goes down, and loses when price goes up.

Note, short trades can be much riskier than long trades.

3. Select coin(s) to trade.

Multiple bots sharing the same wallet in cross mode reduces risk, i.e., diversification. For example, choosing to trade with 8 bots (or coins) each having a wallet exposure of 0.125 (maintaining a total wallet exposure limit of 8 * 0.125 = 1.0) may be preferable over engaging with a single bot limited to a wallet exposure of 1.0. This preference arises from the decreased likelihood of encountering a market crash where all 8 coins are affected, compared to the risk associated with a single bot.

Note, large market capitalization coins are less risky than small-medium coins. Also, mature/aged coins are less risky than young coins.

Keep in mind the general correlation between risk and reward.

4. Optional feature.

When trading with multiple coins, Passivbot has an automatic-unstuck feature which can be turned on or off. When turned on, for example, if a position becomes stuck, the bot will use profits made from other coins to offset losses in the stuck position, thus freeing it from being stuck. If multiple positions are stuck, the stuck position whose price action distance is the lowest is selected for unstucking. When turned off, Passivbot will not realize any losses for any stuck position and the position(s) will remain stuck until favorable price action occurs. To learn about the parameters involved in the automatic unstucking, refer to this default setting (i.e., loss_allowance_pct, stuck_threshold, unstuck_close_pct).

You are ready to analyze…

Calculator General Information:

1. Performance metrics are based on backtested data (i.e., passivbot is given historical price chart to simulate performance) for each coin and are available here. The configs for each coin run by Passivbot Manager are from this directory (unless otherwise provided by the user).

2. Average Daily Gain (ADG) is the result from backtests, and actual robot live performance will probably differ significantly. Hence, this is NOT a guarantee of performance (refer to Terms and Conditions).

3. Depending on whether automatic unstucking is on/off, the actual robot live performance will vary.

4. If the user cannot meet the minimum wallet funding requirement for optimal performance, the passivbot manager can adjust configuration settings to accommodate a lower balance, albeit with reduced gains (i.e., suboptimal performance). This adjustment will only be made at the user's request.

General Risk Behavior:

*If the user chooses not to customize or select their own trading strategy, they have the option to request the Passivbot Manager to implement a "default" low-risk trading setting*

The user acknowledge that this calculator and the content of this website is for informational purpose only, and is not an advise nor a guarantee of performance or returns (refer to Terms and Conditions).